Maker: Past, Present and Future

I think there is a good chunk of folks in DeFi who have a mental model of Maker being “that protocol that issues DAI loans against various ERC20 tokens”. This was certainly the model circa 2020 before the explosion of DeFi in the summer, but things have evolved quite a bit since then. I’m writing this article to describe the evolution in thinking amongst the DAO from then to now as well as where I believe we are heading.

March 2020 — Black Thursday

With the Pandemic just kicking off we all remember the events of Black Thursday where crypto markets dropped by 50% in a single day. The then 4-month-old Maker protocol came very close to collapsing due to unprecedented stress as well as an oversight in how the auction system worked. But we prevailed… barely.

While most of the attention was on the failed liquidations and MKR mints to recapitalize, something more subtle occurred on this day as well. This was the day that demand for holding DAI exceeded the demand for ETH leverage.

Until that day Maker had the opposite problem. DAI was consistently trading below peg. You may wonder what the issue is with DAI being worth more than a dollar. Isn’t this a good problem to have? Oddly enough it’s a harder problem to deal with than a stablecoin trading below a dollar.

It’s all about the supply and demand balance. Too much DAI supply depresses the price below $1 as people mint and sell DAI to take on leverage or other use cases.

Maker has two strong tools to deal with this: Stability Fees and the Dai Savings Rate (DSR). The former disincentivizes supply growth by charging more to take loans. This will cause some to re-evaluate whether they want to take leverage at the new higher interest rate or even possibly repay some previously taken loans. This is the stick.

The DSR is nicer. It incentivizes more DAI demand by offering a risk-free interest rate for just holding DAI. This is in addition to any lending rates offered by Compound or Aave.

After Black Thursday things flipped and we had too many people wanting to hold DAI. More than the number that wanted to mint for leverage. DAI price broke upwards by as much as 6 cents. At the time Maker had no levers to either decrease DAI demand (negative interest rates) or increase supply (non-crypto collateral).

USDC to the rescue

As an emergency response Maker holders elected to onboard USDC to wrangle the peg back in line, and it worked! But there was an ideological cost. It was our first custodial, blacklistable, centralized asset.

It’s fairly clear to me that DAI would not be around today if we didn’t take the steps we did. Some wanted to take the negative interest rates approach, but my personal view is that would have been catastrophic for the trust people place in DAI.

In a startup you want to focus at aggressive growth at almost all costs. It’s grow or die survival of the fittest. Single-Collateral Dai had only one lever for controlling supply, but Multi-Collateral Dai introduced the DSR which works by growing DAI demand instead of trying to penalize borrowers. Using the DSR is something I was personally advocating for from the launch.

Similarly by using USDC instead of negative interest rates we can continue to grow the protocol instead of penalizing our user base. This is why I was in favour of growing the supply by adding USDC as opposed to introducing a negative interest rate mechanism.

My mental model at the time was that the market would eventually turn bullish again and we would return to the happy go lucky world of positive interest rates without the need to lean on centralized assets. But then DeFi summer happened…

Compound came up with the ingenious idea to mint a speculative governance token and hand it out to liquidity providers. This turbocharged demand for all assets in Compound — including DAI. Yield farming was born. We had no choice but to bring on more USDC else risking the peg exploding upwards again. Once again we had solved the problem, but were stuck with a large amount of USDC backing DAI which was viewed by some as undesirable.

The addition of USDC continued with the culmination of the Peg Stability Module (PSM) towards the end of the year effectively hard pegging us to USDC and thus USD. With the market turning bullish again relief seemed to be coming.

2021: The Year of the Farmer

During the first part of 2021 it was becoming more clear that beyond ETH and WBTC, demand for borrowing stablecoins was pretty much non-existent at the scale of billions of dollars. This was a switch from the previously held belief that onboarding small cap ERC20s (LINK, UNI, MATIC, etc) would help with the DAI supply in a meaningful way. In a lot of cases the cost of running the oracles was higher than the revenues these collaterals brought in.

Another effect was emerging as well. The yield farming model was exploding in popularity, and almost every protocol was fighting tooth and nail for stablecoins. Token emissions from yield farms was usually a constant rate, so when the markets went up it would increase the USD value of these tokens and thus the APY of the liquidity pools. This in turn would increase demand for DAI. During market downturns people choose DAI as a flight-to-safety asset and thus demand also went up. Apart from temporary reversals, the trend of DAI supply has been mostly up-only which to be fair is a good problem to have.

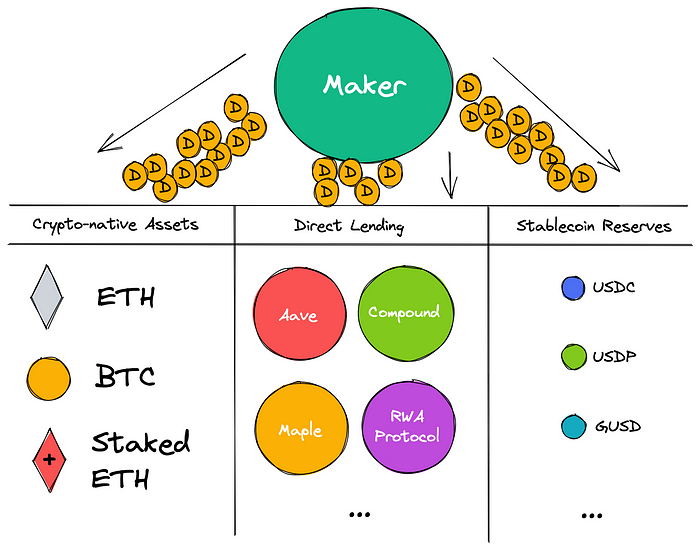

What was becoming crystal clear this year (if it wasn’t already) was that if we want a decentralized stablecoin that can scale to 100B+ it will need to include a wide range of Real World Assets (RWAs) to back it. The first was USDC, but it certainly won’t be the last. In 2021 we onboarded USDP (rebranded from PAX USD) and GUSD to help diversify counter-party risk. Some may see this as just yet more stablecoins, but it is an important piece to achieving emergent decentralization via centralized components.

A fundamental point I want to get across is that you cannot scale a stablecoin by backing it purely by crypto-native assets. There is simply no way to do this. All stablecoins must be over-collateralized or risk collapse, and there is simply not enough value available purely in crypto-native assets to do this. There is no alternative but to tap into real world assets, and no amount of fancy algorithms will get around this fact.

Therefore it is imperative that we tokenize more assets from the real world — especially in different jurisdictions. This is how we scale DeFi. The alternative is crypto remains a niche gambling product and fades into obscurity.

Direct Lending

When MCD launched in November 2019 DeFi was pretty much Maker, Compound and Uniswap. However, a few months later Aave V2 was deployed offering probably one of the best retail lending experiences to end users. Cross collateralization, lots of assets, multiple stablecoins options made Aave the killer lending app.

This was a pivot point for me. Maker at its core is not a lending facility. Maker’s main product is the DAI stablecoin. Lending is simply how we control the peg. Instead of competing with products like Aave and Compound, we could instead provide them with privileged access to mint DAI on demand. This would allow Maker to get exposure to part of Aave’s user base. In exchange Aave gets access to stable interest rates. It’s a win-win.

Thus the Dai Direct Deposit Module (D3M) was born. Instead of competing on the retail side of things, Maker could instead delegate minting rights authority to protocols that specialize in particular market segments. The low hanging fruit is the crypto-lending markets, but there is no reason this cannot be attached to real world lending markets such as Maple or others.

This is not to say we should abandon lending directly to users altogether, but sticking to the primary crypto-assets only (ETH, BTC and staked ETH) makes sense moving forward.

The Future of Maker

In my opinion the future of Maker is delegation. Instead of messing around with individual assets, MakerDAO can focus on due diligence at a high level. Evaluating whether to extend DAI minting rights to entire protocols.

This is similar to the relation between commercial and central banks. Central banks provide liquidity to commercial banks which in turn can offer highly specialized services to their customers. It’s not the job of Maker to be the best at everything. We can use the DeFi legos to construct something bigger than the sum of its parts.

I’m optimistic that protocols will emerge that deal entirely with extending credit facilities to the real world. We’ve seen some small scale experiments so far, but this needs to be kicked up a couple orders of magnitude to scale the ecosystem. Maker will be ready when these protocols emerge, and there is a gold-mine awaiting whoever cracks this nut first.

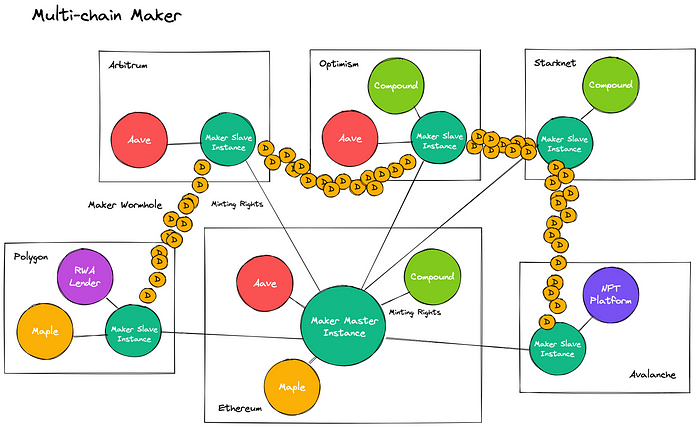

It’s clear now we are entering a multi-chain world. Work is being done to expand Maker out into every reputable L2 and side-chain as Ethereum switches to becoming purely a settlement layer. This combined with the Maker Wormhole network will make DAI one of the most liquid cross-chain assets available.

In the long run the Master Instance of MCD will ossify and innovation will push out to the edges in a decentralized manner with completely independent teams building new and innovative products. The core protocol will protect itself via debt ceiling allowances to these teams. Heavily diversified risk is the key to survival here. Core protocol updates will be few and far between with time-locks of months or years. A product people can truly depend on.

Eventually DAI will de-peg from the USD as it becomes competitive as one of the global reserve currencies. This is the end state of Maker I see — a rock solid, credibly neutral foundation to for the world to transact on. Let’s get building.